Independent Stockmarket Research and Advice since 1981

Since 1981, Securities Research has been helping private investors achieve significant wealth through stockmarket investment. Our portfolio has grown an impressive 500-fold over 43 years, a compounded annual return exceeding 20%. Our independent research and unbiased advice empowers investors to navigate the markets and achieve their financial potential. Join us in building a prosperous future through smart investing!

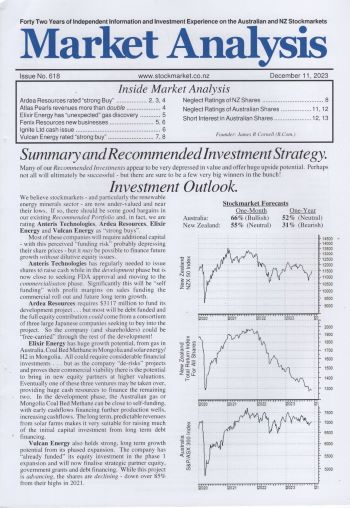

Subscribers can download

the current issues of "Market Analysis".

In 2001, after two decades of publishing this newsletter, a skeptic from the newspaper realm remarked, "At least part

of your success probably is attributable to a long string of

luck", highligting "the remarkable success of just one

recommendation", NZ Refining", which was sold in 1996 for a

34-fold gain.

|

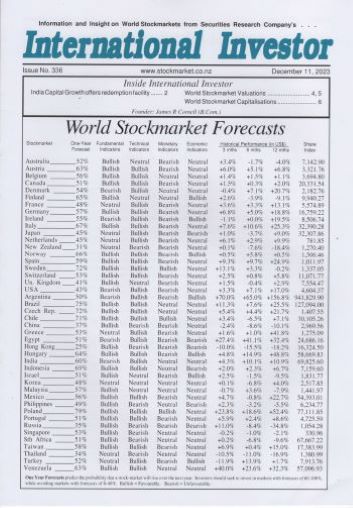

Subscribers can download

the current issues of "International Investor".

|

||||||||||||||||||||||

Online

Share Selection This database

covers all Australian and New Zealand listed companies,

including data for many valuable share selection

techniques that are not available from any other source

(e.g. Relative Price Strength ratings, Insider Buying and

Selling over the last 52-weeks, Price/Sales ratios,

Broker Neglect). |

Email: james@stockmarket.co.nz Phone: 060-14-354 2066 Copyright: Securities Research |